Gold Mining and Exploration in West Africa

One will inevitably come across Africa when searching for Gold mining stocks. Africa’s gold mining industry, which was traditionally dominated by South Africa, has seen a shift in focus with West African countries like Ghana, Mali, and Burkina Faso entering the fray. In fact, South Africa’s gold mines, once the top gold producers in the world by a wide margin, have been slowing every year since 2013 and the country was overtook as the top gold producer in Africa by Ghana in 2019. This, ultimately, presents lucrative opportunities for investors who want to invest in Africa and gold stocks

As such, major players in the gold mining industry like Newmont Goldcorp, Kinross Gold, Anglogold Ashanti, Barrick Gold, and Gold Fields are active in the region with several operations. Several smaller players are also playing their part, which means, overall, it might be a good time to invest in Africa gold stocks.

But why this shift to West Africa?

High grade gold at Dakouli II (NXS.V)

Why West Africa?

West Africa is rich in mineral resources and many world-class deposits have been discovered there in recent times. It’s a key source of iron ore, bauxite, diamonds, phosphate, and uranium. Because of this untapped mineral wealth, it provides exceptional greenfield development potential.

Despite increasing interest in these commodities in West Africa, the region is a hotspot for investment in gold mining and gold exploration. Because the gold mining industry in the southern countries of the continent keeps shrinking, producers and prospectors are increasingly looking to West Africa where large parts of it have barely been explored.

Step aside Canada, Australia and SA: West Africa is fast becoming the hottest ticket in gold mining.

Producers and prospectors are pouring money into the region as prices rally and the industry at the southern tip of the continent keeps shrinking. While gold miners face a dearth of new discoveries globally, large parts of West Africa have barely been explored. The deposits tend to be shallow — meaning easy access — and relatively low-cost.

At least two new projects started up in 2019 and a further two are scheduled for 2020. AngloGold Ashanti is expanding and modernising its Obuasi mine in Ghana and Canada’s Iamgold is considering a new operation in Senegal. In July, Resolute Mining agreed to buy another West Africa-focused producer.

Also, the gold deposits in this region tend to be shallow which means it’s easy to access and cheaper compared to other regions. In addition, it boasts some of the highest grades of gold deposits in the world and averages about 1.8 grams per tonne. In fact, according to the world’s number three gold producer, Anglogold Ashanti, West Africa is brimming with potential and their Obuasi mine will be a significant production engine for many years to come.

With West Africa boasting some of the highest grades of gold deposits globally, averaging about 1.8 g/t, it has become the investment hub for gold projects over the past seven years.

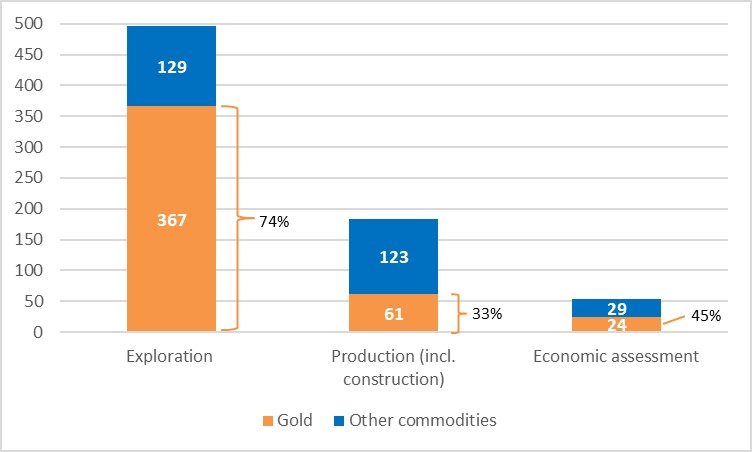

International commodities consultants Core Consultants MD Lara Smith states that 74% of all exploration projects in West Africa are focused on gold, which demonstrates the importance of the gold industry, as well as its investment potential.

“With a compound yearly growth rate of 2.9% in production from 2012 to 2016, investment in gold in West Africa is attracting notable investors. This is in addition to the increase in exploration for all precious metals,” Smith states.

The epicenter for the gold mining action seems to be the Birimian belts, a large section of ancient, gold-rich volcanic rock that stretches from Sahara to the Atlantic Coast. Although this region is no stranger to gold mining and has a long history of it, vast expenses of the region remain mostly untapped because of its size and political insecurity in the region.

Although prospecting activity slowed due to the declining gold price after it reached price highs in 2011 and 2012, with the gold price rising again, producers are, once again, starting to tap into the region.

As a result, mining companies have invested billions of dollars in gold exploration and mining activities in the region during the past few years. This has made West Africa the fastest growing mining region in the world.

The Numbers

As of March 2019, there were 184 production assets in the West African mining region with 61 assets or 33% focused on gold. At that stage, there were 53 assets that were undergoing economic assessment studies and of this number, 24 or 45% were gold assets.

More astounding, though, is that, at that stage, there were 496 exploration projects and of these, 367 or 74% focused on gold. This focus on gold exploration is important because it shows that interest in West Africa’s mining sector will only increase in the future as these exploration projects enter the production phase.

Also, despite this exploration activity, experts believe that significant local gold resources are still not explored. This can, in turn, spark even more interest from the international mining community.

And once these mines start production, another benefit comes into play, the high remaining life of operating mines in West Africa. Generally, these mines have an average of 16 years remaining, while mines in Mali have an average of 19 years remaining. With the continued expenditure on exploration and an approximate 65% conversion rate of resources to reserves, the average mine life in West Africa could rise to 22 years.

This untapped potential is only one part of the equation, though. The other part which is also a large drawing card for investors is the lower production costs in the region compared to other gold mining regions.

For example, in the World Gold Council’s all-in sustaining costs metrics for 2018, two West African gold mines were in the global list of the top six lowest cost mines. B2Gold’s Fekola mine in Mali was the second lowest cost mine and Perseus Mining’s SGP mine in Ivory Coast was sixth.

Drawbacks of Mining in West Africa

While it does have some of the richest goldfields on the African continent and offers mining companies a lower cost of mining, there are also drawbacks to mining in West Africa which can deter some investors.

For one, there is the geopolitical risk in certain of the countries in the region while there is consistent tension between governments and separatists who want to extend their influence on the continent.

Probably one of the biggest drawbacks, though, is their reputational risk of mining in the West African region. There’s an established black market for gold and the prevalence of illegal mining creates a major impediment to securing investment. In fact, the West African gold market has the highest incidence of artisanal mining which can equate to up to 50 tons of gold per year.

Apart from these there are some other more conventional challenges like the lack of skilled workers and basic infrastructure. Despite this, investors with more of a political risk appetite and with their legacy of mining in the region, will stay and continue to operate their mines in West Africa.

And if they do, there’s good money to be made.

Conclusion

Many gold stocks have made significant profits from West Africa. Roxgold is an example of a company with mine in Burkina Faso that has appreciated almost 84% over the past 2 years.

While it may not be possible to go back in time to buy some Roxgold stock, it is certainly possible to replicate it by buying a similar gold stock with operations in Africa – one that is worth 240%+ the current market price. We remain strongly bullish on Nexus Gold Corp (NXS.V). NXS has a massive portfolio of 11 assets, with district scale properties totalling 750 km sq in West Africa, and 6 properties in Canada. The company is worth 24 c using very coservative estimates, and is trading at a mere 7 c as of today, being the cheapest by market capitalization compared to peers in their 2 active properties. The company also has an active project (McKenzie project) in the Red Lake district in Canada, which is home to Canada’s most recent producer. This is a great time to buy the dip in an extremely undervalued stock that claims ownership to district scale real estate and has produced gold samples like this:

A bonanza grade of 331 g/t Au historical sample in McKenzie Lake (NXS.V)

You can read the full report on Nexus Gold that was released on February 22, 2021 here:

Nexus Gold Corp (TSXV:NXS) – District Scale Gold Assets in West Africa and Canada