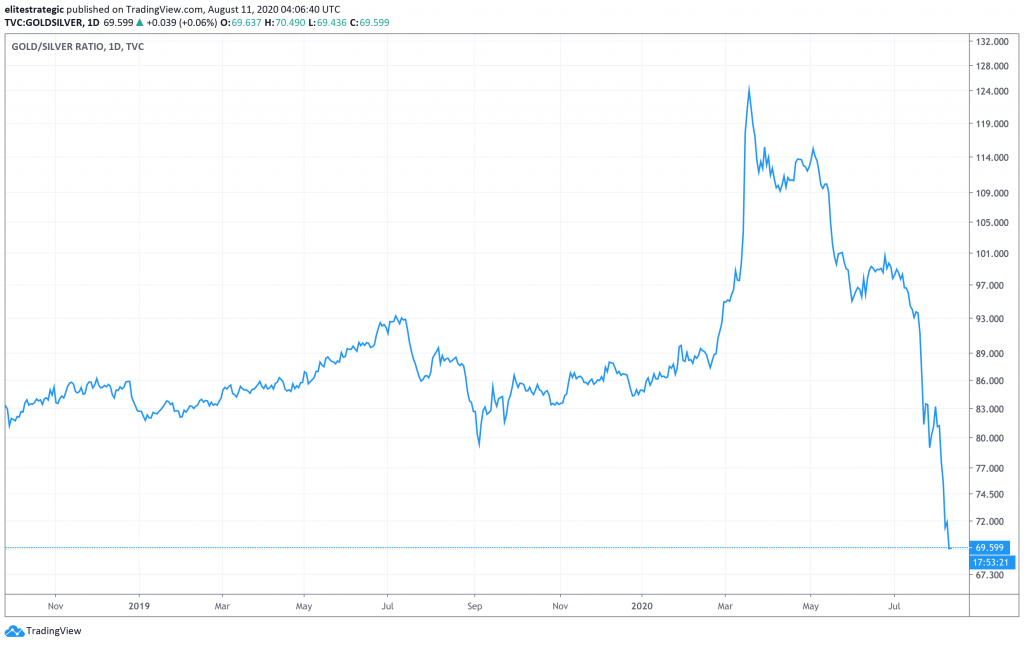

Huge correction in Gold/Silver ratio

We have talked about the Gold / Silver ratio here a few times. The Gold / Silver ratio is a measure of the price difference between gold and silver. It’s used as a gauge for various purposes, one of them being whether silver is undervalued and/or gold is overvalued. Professionals use this metric as a tool to make this determination. We have previously talked about the gold / silver ratio showing a very (insane?) high number, meaning gold is priced much much higher than silver. We thought this was too high. In other words we thought silver was just far too cheap.

We were right. There was a massive correction in the gold silver ratio:

From a high of 126.4, it is now at 69.59… huge drop in a few months. Silver at the same time has been flying:

By no means should this take away from Gold, which has broken previous records. Gold mining stocks are doing great right now. Gold is the popular one though, and does get all the attention. What is less popular is that other commodities have surpassed the gains on a percentage basis.

Conclusion

This is likely the result of the money printer going brrr and it has creeped into commodities. Many analysts had predicted this to take place 10 years ago, when these trillion dollar bailouts started showing up for the first time, but it appears to finally be showing up now. Gold has broken record all-time-highs, silver is flying at an accelerated pace, Iron Ore is above $118 a ton. This is a great time to be buying junior mining stocks / penny stocks / microcaps / any word to refer to the same thing.

With all the money in the system, commodity stocks are poised to rocket. The party is just getting started.