The Effect of Canada’s Rising Inflation on Mining Stocks

The Canadian annual inflation rate doubled to 2.2% in March 2021, up from 1.1% in February 2021. Previously the central bank indicated it would take until 2023 before inflation returned to its 2% target. Now, the central bank says it would happen in the second half of 2022.

Previously, the Bank of Canada had said it would be 2023 before inflation returned sustainably to its 2% target. On Tuesday, the central bank said it would happen in the second half of next year. In the meantime, inflation would temporarily breach its target, the bank said.

However, some analysts believe that the inflation rate could even test 3% later this year because of a combination of higher commodity prices and the statistical comparison with the economic downturn because of the COVID-19 pandemic. Some analysts believe that there are some signs of underlying inflationary pressures that are showing up in the Canadian economy, so inflation could rise even further.

Canada’s inflation rate accelerated to 1.0% in January on higher durable good and gasoline prices, up from a year-on-year increase of 0.7% in December, and beating analyst expectations of 0.9%.

Before easing again, the annual rate could test 3% in April or May due to a combination of higher commodity prices and the statistical comparison to the period of last year’s shutdowns, analysts said.

“In the next few months, with the run-up in oil prices in particular … and when we compare ourselves to what happened a year ago, we are going to get some very big inflation numbers,” said Doug Porter, chief economist at BMO Capital Markets.

But is this number an accurate reflection of the inflation experienced by the average person? What is the effect of rising inflation on mining stocks, penny stocks, and any other investments?

What is Inflation?

Before looking at these questions in more detail, it’s important to understand what inflation is. Simply put, inflation is a measure of the rate at which the prices of goods and services in an economy rise. So, if inflation increases, it leads to higher prices for basic necessities like food and it can have a negative impact on society.

Inflation can occur in nearly any product or service in an economy. This includes necessities like housing, food, medical care, and utilities as well as other luxury items like cosmetics, cars, and jewellery. When this inflation becomes prevalent across all parts of an economy, it creates concerns under consumers and businesses.

This is simply because it reduces the value of money. In other words, it makes money saved today less valuable than tomorrow. It erodes a consumer’s buying power and can interfere with an individual’s ability to retire.

As a result, most of the central banks of developed economies, like the Bank of Canada, have inflationary measures in place and adjust their monetary policy to combat inflation. The metric they typically use to measure inflation is the consumer Price Index (CPI) which measures price changes over time.

The Problem With CPI

The problem with CPI is that it doesn’t actually measure inflation, as many precious metal advocates have said numerous times in the past. It measures consumer spending behaviour. As a result, the official CPI figure is often much lower and more conservative than the reality. And it’s this lower figure that the central bank uses to set policy and determined pensions.

The most commonly quoted measure of inflation in Canada is the Consumer Price Index (CPI). The only problem is it doesn’t measure inflation, it measures consumer spending behaviour. It’s used by the Bank of Canada (BoC), and the Canadian government to help set policy, and determine pensions. Naturally, it skews much lower and more conservative than reality. Officially, CPI was only 1.6% in the year ending April 2017 – which has many journalists and politicians incorrectly claiming that inflation was only 1.6%. If you’ve been suspicious that inflation is higher, you’re probably right.

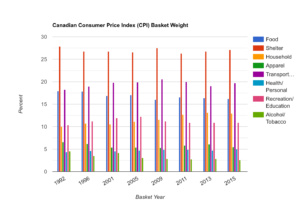

To calculate CPI, Statistics Canada uses a weighted basket of goods and services which are grouped and broken down into eight categories. In other words, they use the prices of these goods and services and give them a weighting in accordance with the percentage of their income Canadians generally devote to this basket.

The problem with this approach is that these weightings are unrealistic. For example, a survey from trillion-dollar fund Blackrock found that the average Canadian spends 43% of their income towards housing, whereas the weighting in terms of the CPI calculation was only 27.15% in 2015.

Another big problem with the CPI is substitution bias. So, when Statistics Canada measures the products for the basket, they’ll substitute what they call comparable items for the cheapest one. For example, they use the example of coffee and tea. If coffee is cheaper, they’ll use that in the calculation. In contrast, if tea is cheaper, they’ll use that in the calculation.

Unfortunately, reality doesn’t work in that way and people will not necessarily choose a comparable item because it’s cheaper, but they will choose an item according to their preference even if it’s more expensive. As a result, the CPI isn’t an accurate way to gauge how the cost-of-living changes.

Ultimately, because of this, CPI is a lagging indicator of inflation and not a good indicator of current inflation. According to David Ranson, an US economist, the price of commodities is a far better indicator of current inflation because inflation initially affects commodity prices and it may take several years for this effect to take hold in the broader economy. As a result, he bases his inflation measure on a basket of precious metals.

The Effect of Inflation on Mining Stocks

In contrast to CPI, commodity prices are a leading indicator of inflation. This is because measurable economic changes affect them before affecting the economy as a whole. One theory for this is that commodity prices respond quicker to general economic shocks such as increases in demand.

So, the suggestion is that precious metal prices benefit from inflation. As a result, this makes gold, silver, platinum, and palladium natural hedges against inflationary monetary policy. Also, because of the rising prices when inflation occurs, the value of a local currency falls. Thus, as inflation increases, so does the price of precious metals.

We are seeing significant moves in commodity prices, with Copper having recently closed at $4.557/lb!

According to 2015 research, researchers analyzed a dataset of local currency gold and silver prices against consumer price indices for the US and UK. The results showed that precious metal prices shift, in the long run, in line with overall inflation. In other words, as inflation arises, so does the price for precious metals. The research also showed the relationship between gold and silver prices and expected inflation

Ultimately, this means that, as inflation in Canada rises, so will the price of precious metals. As a result of the fact that commodity prices significantly affect stock prices, it’s also a given that mining stocks will see prices increase along with inflation.

The Bottom Line

The Canadian inflation rate doubled to 2.2% in March 2021, and it’s expected it could rise to 3% later this year with underlying inflationary pressures showing up in the Canadian economy.

As a result of this metal prices will rise increase as inflation increases with the necessary effect that stock prices for mining companies will increase too. This, ultimately, means that now is a good time for investors to hedge against inflation. One option to consider is investing in Canadian mining penny stocks, which presents a perfect opportunity for diversification and the possibility of increased returns as inflation increases. Keep in mind penny stocks come with a higher risk appetite, however commensurate with the risk there is the potential for out-sized returns.

How to play this

There are numerous approaches to capitalizing on looming inflation. We have already seen substantial run-ups in commodity prices, and our first report on Black Iron Inc was one such example, gaining 500% since we initiated coverage in July 2020. Another example would be TOC, which gained 125% since we covered it in November. However, if you missed out on the runs in BKI and TOC, fear not as there are other excellent trading opportunities. Here are 2 mining stocks that can position you to play the inflation trade:

Etruscus Resources (ETR): We recently published an update report incorporating the upside potential derived from recent exploration. With neighbouring peers increasing in value on average over 310% over the past 1 year, and the company hosting substantial high-grade Silver, Gold, Copper, Lead and Zinc, the upside potential in this mining penny stock is very real. We’re not the only ones who have noticed this. We estimate the stock to be worth $1.50, however it’s only trading at $0.275. You can read our full reports, and summary on ETR here.

Nexus Gold (NXS): Nexus Gold has 11 assets, the majority of which are 100% owned, spread across Canada and West Africa. Their assets in West Africa encompass a staggering 750 sq km, aka district scale property. The market has overly discounted NXS’s substantial asset base. At current valuation, NXS is the cheapest by market cap when compared to peers in West Africa and Red Lake, Ontario. The upside is immense here, as the sheer scale of their assets lends them the opportunity for substantial price appreciation. We estimate the stock to be worth $0.24, however it’s only trading at $0.05. You can read our full report on NXS here.