Sintering restrictions support Iron Ore pellet prices

It would appear as China is increasing the use of Iron Ore pellets. This is due to pollution control measures and the recent halting of Australian thermal and coking coal.

Pollution control measures imposed on steelmakers in Tangshan have limited consumption of iron ore fines, prompting mills to switch to direct-charge raw materials, such as iron ore pellet and lump, a buyer source in Beijing said.

The halting of imports of Australian thermal and coking coal in mid-October, led to higher prices for Chinese domestic coal, which in turn prompted steel mills to consume more direct-charge materials because the use lesser amounts of coke.

Offers for seaborne iron ore pellet cargoes increased in the week to October.

Another source indicates that the price of coal is the primary culprit, with some Chinese mills opting for pellets over fines.

According to him, prices of imported iron ore fines are still rather expensive, and that’s one of the reasons why steel mills have slashed their sintered ore consumption. Over the past couple of weeks, the cost efficiency of using lump has declined compared with using pellets, now that coke prices have surged to a rather high level.

The article also says that the consumption of pellets is nearing all time highs.

China’s steelmakers are consuming more iron ore pellets in their blast furnace production these days, new data suggests. As of October 21, the 64 mills surveyed regularly by Mysteel had raised the proportion of pellets in their furnace feedstocks by 0.08 percentage point on fortnight to reach 16.46% – the second highest since the survey was inaugurated in July 2014 and only narrowly lower than the 16.67% record the mills observed at the end of last December.

Consequently, over the two weeks to October 21 the average ratio of lumps in the mills’ melts declined by 0.1 percentage point to 12.51% while the steelmakers’ use of sintered ore in their blast furnaces remained stable at the historical high of 71.03% – up by a mere 0.01 percentage point over the prior survey period, the findings showed.

How to trade this:

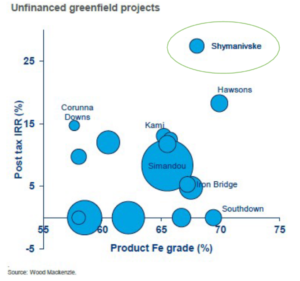

Black Iron Inc (TSX:BKI) owns the Shymanivske deposit. This deposit is host to high grade Iron Ore pellet feed. Black Iron’s 68% Fe content pellet feed product is in the top 4% Fe content globally produced. This currently sells for ~$35/t premium.

We covered Black Iron Inc (TSX:BKI) here. This stock is worth north of $6, and trades at only $0.11. We remain bullish on the stock, and recent events justify this.

Black Iron’s recent press release showed their Iron Ore pellet deposit is another step closer to production, as they move much closer to obtaining production financing:

Management is very pleased to update that as an additional source of funding for Project construction, a second Heads of Agreement with a construction company that includes an investment package valued at ~US$60 million has been signed. For clarity, only one of the current two construction companies will be selected to build the Project, and by having this company make a material investment towards Project construction, their interests become fully aligned with existing investors to complete construction on time and budget. Black Iron expects to conclude a binding construction / investment agreement after the offtake investment has been secured.

We will continue to follow this stock, as this is a rare buying opportunity in our view. Stay tuned.