Iron Ore prices jumps to year high

As mentioned earlier, Iron Ore has breached resistance and appears to be trading at year highs.

Some choice quotes from the article:

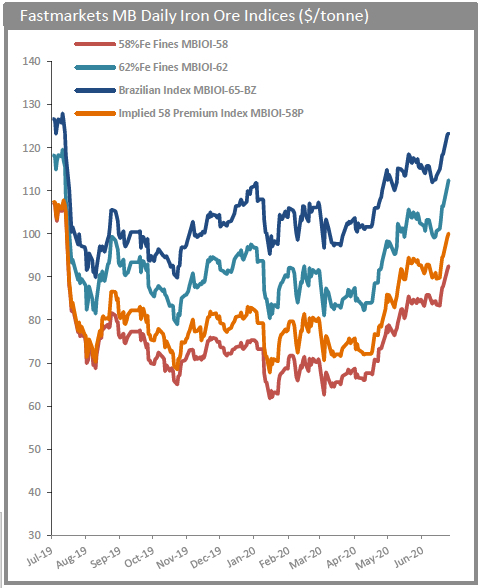

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $112.48 a tonne on Tuesday, up 22% since the start of the year.

China’s iron ore imports jumped 17% in June from the May total to hit the highest level since October 2017, according to customs data released overnight.

…

At the current pace, 2020 full year total would handily beat last year’s 1.069 billion tonnes, which was just below 2017’s record 1.075 billion tonnes.

In a note, BMO Capital Markets estimates that China accounted for over 75% of global seaborne iron ore imports during the second quarter of this year.

That is VERY VERY bullish, and the ABSOLUTE best way to capitalize on this price rise it to buy a near producing Iron Ore mine. Grade is very significant, and as can be seen from the graph above, the higher the grade, the higher the price per tonne. The best stock that comes to our mind is BKI on the TSX. Their flaghsip property – Shymanivske – has a grade of 68% Iron Ore and is near production, with a mine life of almost 17 years. The stock should be worth $3/share based on NAV/share. You can read the report for free here: Black Iron Inc (BKI)

Source of the article below:

https://www.mining.com/iron-ore-price-jumps-to-year-high-as-chinese-imports-soar/