US $1T spend: buy signal for Iron Ore stocks

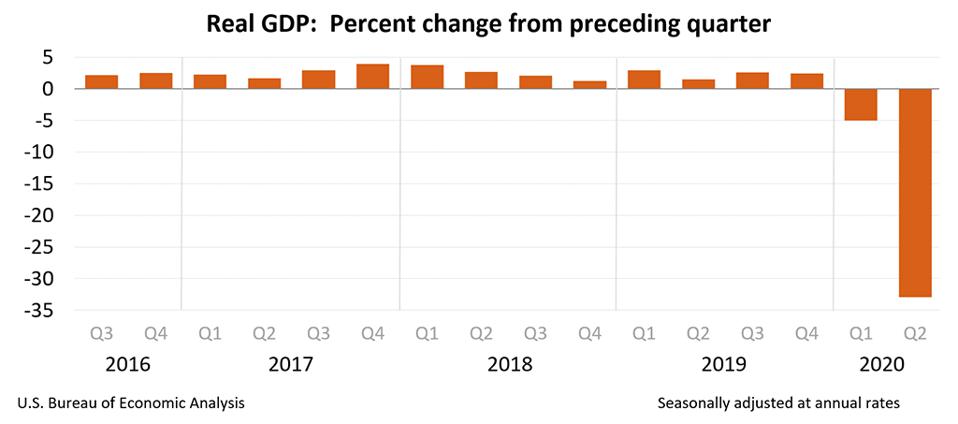

A record 32.9% drop in US GDP this past quarter: Covid-19 has made it’s mark on the world’s most powerful country. However, this is a bullish indicator for those looking for Iron Ore stocks to buy. Government spending on infrastructure is a routine tactic used to stimulate economic growth, and is in fact basic economics for those that study(ied) the subject. It wouldn’t be a stretch to speculate this is a likely course of action, especially when news like this comes out.

This is very bullish for Iron Ore and Copper, and investors need to think about the best Iron Ore and Copper stocks to buy before it’s too late. You never want to miss out on a bull run, only to have your friends tell you how much money they made. There are possibly large cap mining stocks you can buy, but those have such limited upside that it simply will not compare to many 100% returns possible with small caps. The absolute best way to optimize the risk/reward ratio is to find small cap stocks that are cheap, buy them, and watch them appreciate.

Background

Let’s back up for a bit: 2 weeks ago the Trump administration is weighing a massive $1 Trillion infrastructure spending package. Here are some choice quotes:

The Trump administration is preparing a nearly $1 trillion infrastructure proposal as part of its push to spur the world’s largest economy back to life, according to people familiar with the plan.

This is reasonable. After a 32.9% drop confirmed yesterday, spending to stimulate the economy would be the obvious path to take. Just look at that graph! I’ve never seen anything like that before:

The news buoyed U.S. stock futures early Tuesday, including for companies that may benefit from a burst of new public spending. Fluor Corp. surged 11% before regular U.S. trading, while Vulcan Materials Co. climbed 8.3%.

It appears as if some of the more popular stocks had already seen market appreciation as a result of this. This hasn’t been spread across the board, and that leaves money on the table. There are buying opportunities!

Trump is pushing to rev up the U.S. economy — which four months ago was the centerpiece of his argument for a second term — as he trails Democrat Joe Biden in most national polls. The White House has explored ways to shift the next round of federal virus aid from personal financial support to growth-fostering initiatives, such as infrastructure spending.

Again, they need to stimulate the economy. This can not be stressed enough, given the unbelievable impact the pandemic has had.

Trump has periodically called for more spending on infrastructure, including during his 2016 presidential campaign. In March, as the pandemic tightened its grip on the U.S., he urged as much as $2 trillion in new investment in U.S. roads, bridges and tunnels.

Donald Trump has been calling for infrastructure spending and has been consistent about this.

It’s possible that the infrastructure measures currently being drafted could be rolled into the next round of pandemic relief. The House passed $3 trillion in additional stimulus in May, but the Republican-led Senate spurned that bill and will instead weigh its options next month.

…

Infrastructure spending has long held appeal for lawmakers as a way to spur growth, and the pandemic is renewing calls to fast-track roads and other projects. Mary C. Daly, president of the Federal Reserve Bank of San Francisco, called for public-works spending on infrastructure, including projects that could help low-income people.

How to make money off of this

So how do we profit off of this? We remain very bullish on the near-producing Iron Ore stock known as Black Iron Inc (TSX:BKI), as our analysis indicates it is worth north of $3 a share!! With all the attention on Gold and Gold stocks, Iron Ore is not getting the same attention and that means there is a buying opportunity here. Jump in before it’s too late.

On July 6th, 2020 we published our report on Black Iron Inc (TSX:BKI). You can read the full report on BKI by clicking here. Right now it is still cheap and still a great entry point to invest.