Is this recent increase in inflation transitory?

Inflation data from August has sparked up debate as to whether this is still transitory? The reading was the highest in 18 years, reaching an eye-popping 4.1%. An upward trend throughout the year, it is likely a product of the monetary stimulus that was meant to counteract the lock-downs earlier due to COVID-19. In the graph below you can see the CPI going from 2.2% in March, to 3.4% in April, and never falling below 3% since!

source: tradingeconomics.com

Similar numbers are being witnessed south of the border.

The headline number is back to its high of 5.4%, and the core is still above 4.0%, having stopped decreasing. This may well soon pass, but it’s not just a transitory reaction to the pandemic.

Is this transitory?

An interesting opinion piece on Bloomberg, by John Authers, states clearly that the debate as to whether inflation is transitory or not is nearly at an end:

The U.S. consumer price inflation data for September is with us. With it, I will say tentatively, the debate over whether the current dose of inflation is merely transitory is almost at an end. There’s room for much argument about what should be done about rising prices, but there’s no longer any sensible way to dismiss this inflation episode as merely transitory.

The author then looks at various measures of inflation as reported by official sources, and comes to the same conclusion each time:

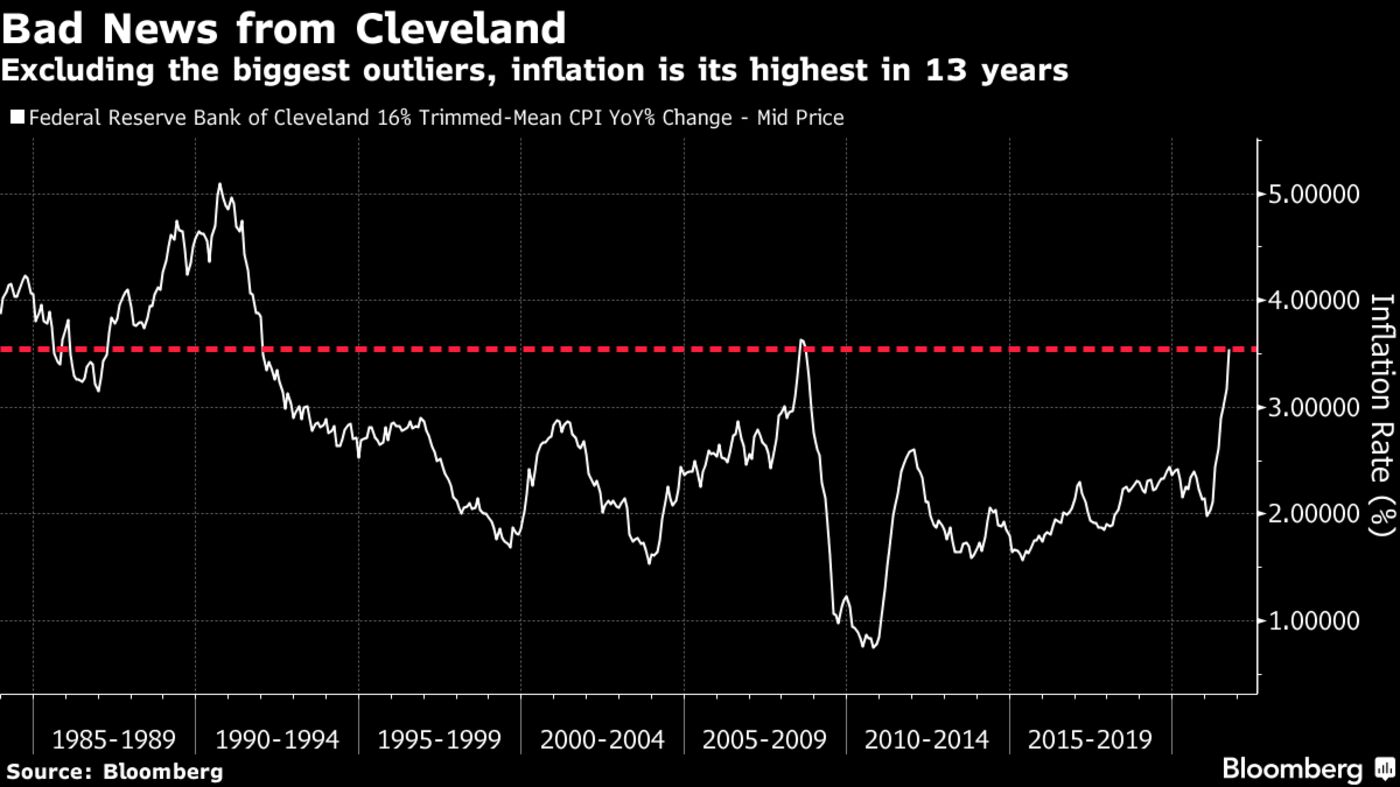

Now let’s look at the “trimmed mean” rate of inflation, as produced by the Cleveland Fed, which excludes the main outliers in both directions, whatever they are. Economists consider this a good and rigorous measure of underlying inflation. And it’s very high:

The trimmed mean rose very sharply for the third month in a row and is far above 3%, the upper range of the Federal Reserve’s target. With the exception of two months during the the worst of the oil-price spike that preceded the global financial crisis in 2008, it’s the highest in 30 years. It’s more than four standard deviations above the the norm for the last decade.

In an interview with BNN Bloomberg, Charles St-Arnaud, the Chief Economist with Alberta Central and former economist at Bank of Canada believes we might be planting the seeds for higher inflation:

In another interview, Stephen Poloz, the former Governor for the Bank of Canada believes inflationary pressures will continue for another 6 to 12 months before “they work their way out”:

How to trade this

An excellent way to expose oneself to the upward movement in inflation is to buy precious metal stocks – specifically junior mining / penny stocks. The return available on small caps / penny stocks can really enhance the ROI of a portfolio. A great way to go about this is to buy early stage mining explorers. Most mining penny stocks trade on the TSXV or the CSE (i.e. on a Canadian exchange).

We remain bullish on Etruscus Resources (CSE:ETR). The company recently announced their private placement, which was initially at $1.5M. Due to overwhelming demand from the investment community, subsequent press released by the company showed that they closed $2.6M and have started the summer exploration program. The company is still the cheapest in the Golden Triangle given the stage of the projects, and has had incredible exploration results. The summer exploration program is sure to be an important milestone and could significantly increase the size of the deposit. Keep in mind this is in a region with monster mines. We published our update report on the company showing that it is worth $1.50 given today’s information.

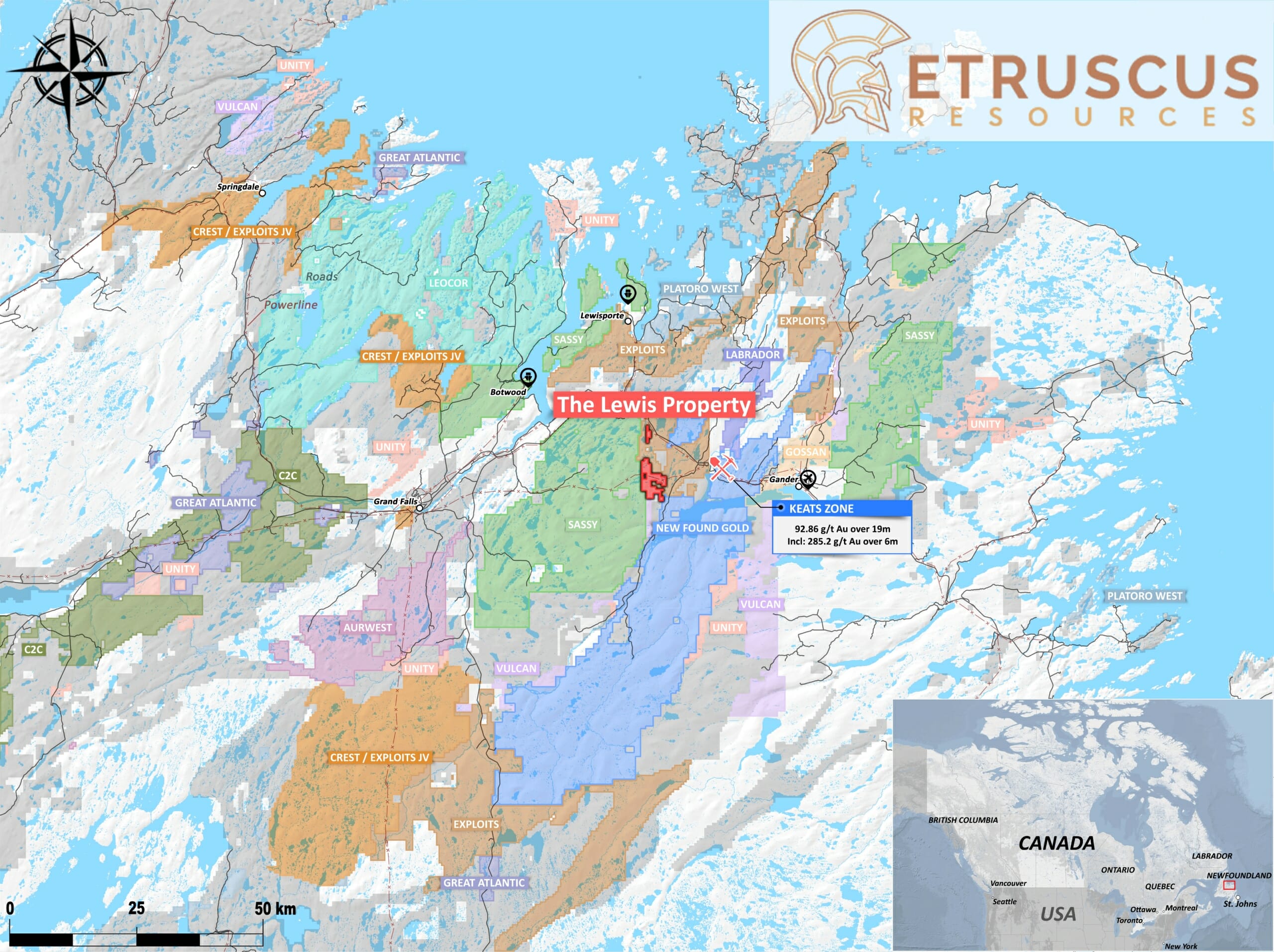

The company also announced the acquisition of the Lewis Gold property in Central Newfoundland. This property is located adjacent to New Found Gold, which has a market cap of $1.4 billion!

With a market cap of $7M, this company is an absolute bargain right now and has the potential to return many 100% of your investment.