Mining stocks have surged — and have 2 more tailwinds

Mining stocks have done well in the recent past. Though there will be investors and traders who are looking at how much Gold has pulled back from it’s all-time-highs, it is important to acknowledge that 6 years ago the thought of Gold trading at $1,800 in 2021 would be considered a large victory. Copper and Iron Ore are both trending upwards, and there continues to be talk of a commodity supercycle.

Marketwatch has chimed in on this topic:

It’s been a pretty impressive 12 months for the world’s leading miners.

The FTSE 350 mining index 156995, +0.21% — which includes diversified mining giants Rio Tinto RIO, -0.02%, BHP Group BHP, -0.13%, Anglo American AAL, +0.93%, and Glencore GLEN, +0.52% — has returned 46% to shareholders over the last year, according to FactSet, compared with the 7% drop for the broader FTSE 350.

The sector is benefiting from a surge in the value of the metals they unearth. Front-month copper HG00, -0.11% futures have jumped 62% over the last 12 months, silver SI00, -0.69% has gained 51%, and platinum PL00, -0.74% has added 32%.

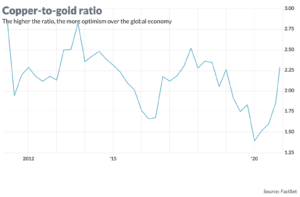

They believe there are 2 factors at play here. A declining dollar, and the rise in the copper-gold ratio.

Jeffrey Gundlach, the DoubleLine Capital chief executive and so-called bond king, has said the ratio of copper to gold closely tracks U.S. government bond yields, which tend to rise as the economy improves.

They then discuss the talk about a commodities supercycle, while bringing up the fact that there aren’t any shorts against large miners.

Also behind the gains are talk by some of a commodities supercycle. That basically means a cycle lasting decades, and moving commodities as a whole. “The commitment by many nations to be carbon neutral and less energy intensive by 2050-2060 requires significant infrastructure investment which will be commodity intensive. Structural models of commodity prices have shown that at each major stage of economic development: agricultural, industrial, and service, commodity usage can change, increasing the likelihood of a supercycle in early stages of development,” says Daniel Jerrett, chief investment officer at Stategy Capital, which started a global macro fund last month.

The talk in the market is of inflation, fueled by lax monetary policy and aggressive fiscal spending. Analysts at Variant Perception, a research firm, have made the case that heightening inflation risks, the need to hedge for them, and “generationally cheap” prices will lead to a commodity supercycle. Among the major banks, JPMorgan also has endorsed the commodity supercycle view.

It is lonely betting against miners at the moment. There aren’t any short positions against the big miners that are large enough to be reported, according to the daily updates from the Financial Conduct Authority.

You can read the full article by Marketwatch here.

This interview with Jeff Currie (Goldman Sachs) corroborates this:

2 ways to play the next commodity supercycle

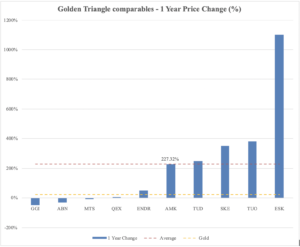

#1 Etruscus Resources (CSE:ETR): Etruscus Resources is the cheapest mining stock in the Golden Triangle by market capitalization. The company recently produced grab samples of 7,013 g/t Silver, 12.7 g/t Gold, 3.9% zinc, 2.4% lead, and 0.2% copper. The Golden Triangle is home to a number of monster mines and consequently multibagger stocks that has made some investors very rich. Absolute monsters like the Eskay Creek Mine saw their company’s stock go from $1 to $67, and similarly for the Snip Mine’s parent company which went from $1 to $28. There is huge upside based on location. In the year 2020, companies located in the Golden Triangle saw an average price increase of 227%!! You can read the Analyst Report on ETR by clicking here.

#2 Nexus Gold (TSXV:NXS): Nexus Gold has an astounding 11 properties, almost all of them 100% owned. They’ve spread their net to West Africa and Canada, and are one of the few companies with 2 flagship operations. With 750 sq km of district scale property in West Africa, and 6 properties in Canada including McKenzie in the Red Lake district, this company is also one of the cheapest by market cap when compared with all their peers. The drill results in Dakouli 2 confirms mineralization and adds new targets that can be further drilled at depth and along strike. With massive scale of this sort, one only needs to see some of the massive players lingering around nearby to whet their appetite. You can read the Analyst Report on NXS by clicking here.