Will Chinese VLOC impact Iron Ore prices?

Another week, another signal that China might be legitimately making long term moves to step away from Australia. Chinese policy to secure Iron Ore has resulted in many acts, including exploring options in Africa, a tried and tested remnant of existing and past policies. The latest update is the construction of Very Large Ore Carriers (VLOC). The impact of the VLOC on Iron Ore price may be significant, as these moves shows that China is quite serious about decoupling from Australia as their primary supplier i.e. 60% of their Iron Ore im ports. Should the trade war get further heated, we can be assured VLOC will cause a higher Iron Ore price.

ports. Should the trade war get further heated, we can be assured VLOC will cause a higher Iron Ore price.

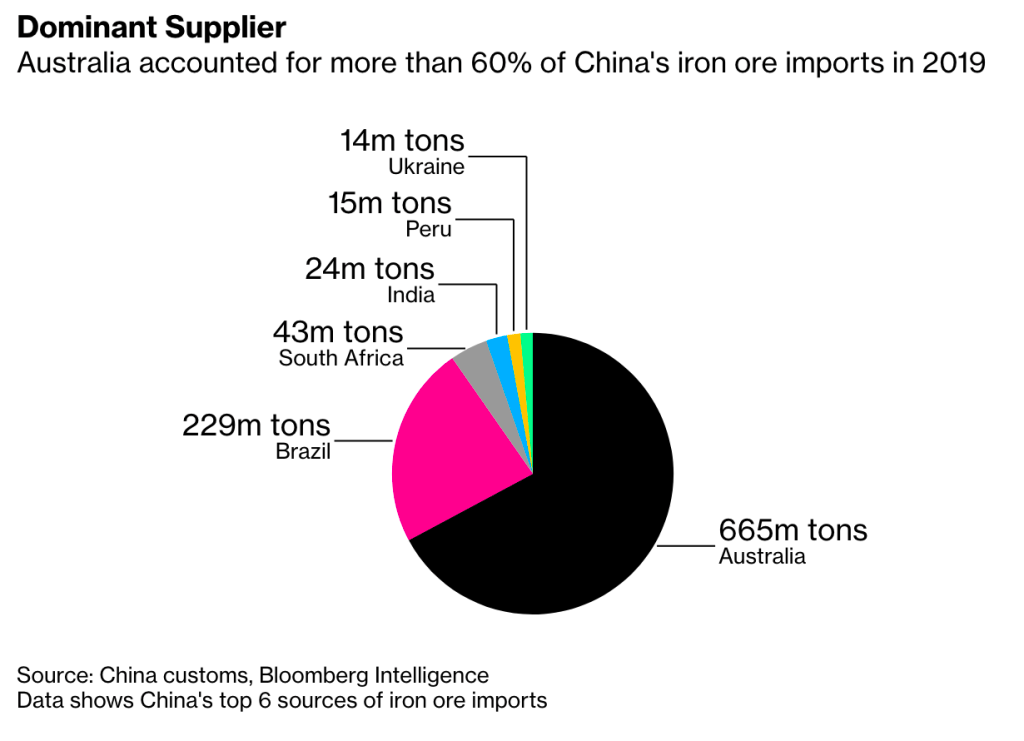

The trade spat started when Australia asked for an independent probe on the novel coronavirus aka Covid-19. This resulted in a minor trade war, one that hasn’t been making the headlines, but one that has major impacts on the market. China imports 60% of their Iron Ore from Australia, and 20% from Brazil, with the remainder coming from a variety of other countries.

The construction of these transportation vehicles has many analysts believing that China will almost certainly reduce reliance on Australia for supply of Iron Ore in the future.

China’s decision to construct a raft of new very large ore carrier (VLOC) terminals is being interpreted by some analysts as part of a bigger geopolitical play to cut the nation’s reliance on Australia for its iron ore imports amid a severe souring of diplomatic ties between the two Asia-Pacific nations.

Beijing’s National Development and Reform Commission (NDRC) has given the green light for four new VLOC terminals to be built in Rizhao, Yantai and Lanshan in Shandong province, and Sanduao in Fujian province to go alongside the existing seven VLOC terminals.

“Commentary on the move has speculated that Beijing is seeking to ensure greater ‘iron ore security’ for the future, not only by opening itself to a wider range of of markets, including Brazil, but also to countries where there is less chance of political disagreement,” Alphabulk pointed out in its most recent weekly report.

Australia, which exports 90% of its iron ore to China, has been a vocal opponent of China’s telecoms company Huawei, and also recently joined the US in opposing China’s maritime claims in the South China Sea. It was also the first country to come out and call for an international enquiry into China’s handling of Covid-19.

China has responded by restricting Australian coal and barley imports. As well as Brazilian miner Vale, Alphabulk suggested African miners could benefit from the long-haul routes made possible by the new terminals.

Vale would also have a greater operational flexibility as the new terminals would enable it to blend different ores more easily to cater for the individual needs of geographically dispersed steel mills.

Conclusion

This is very consistent with the trend indicating clearly that China is looking for sources outside of Australia for Iron Ore. China’s Iron Ore security policy appears to be en route and may very well be a reality in the not so distant future. The trade war dispute between the US and China has legitimate impacts on China-Australia relations and as a result, Iron Ore prices. This is largely due to the fact that china is the single largest consumer of Iron Ore in the world today.

What ultimately transpires out of this will depend on how the discussions progress between Australia and China. However, given the most recent events around the world it is reasonable to believe that the trade war may get worse. It is certainly a realistic view to take, but it remains to be seen, and one needs to make their own predictions regarding where this will land.

A great way to capitalize on this is to buy an ultra-high grade iron ore mine that is nearly in production and worth over $1.85B. This stock is worth at least 2,000% more than the price it’s currently trading at just from NAV alone. We were very harsh in our analysis, which you can see for yourself. Using neutral assumptions that number should be more than 4,000%!!

Beijing’s new ‘iron ore security’ policy puts Australian miners on edge